tucson sales tax rate change

The department has an agreement in place with municipalities that includes a process for tax rate changes by any city or town. Through this site you can apply for a new Tucson business license file a business sales tax return pay license fees and taxes due review account information and contact tax and license representatives for help with any questions you may have.

Solved I Struggled With The Automatic Sales Tax Setup Now I Can T Do My Classwork

On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No.

. The December 2020 total local sales tax rate was also 8700. This page does not contain all tax rates for a business location. This rate change is the result of the November 7th City of Tucson General Election where voters approved Propositions 202 and 203 which authorized a tax increase to support the Reid Park Zoo.

029 USE TAX PURCHASES 25 26 030 USE TAX FROM INVENTORY 25 26 037 CONTRACTING OWNER BUILDER 25 26 213 RENTAL REAL PROPERTY 25 26 214. Accordingly effective February 1 2018 the rate rose from 25 to 26 increasing the total retail sales tax rate in Tucson AZ from 86 to 87. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250.

The minimum combined 2022 sales tax rate for Tucson Arizona is 87. Please note that effective February 1 2018 the City of Tucson Business Privilege Tax Rate has increased one tenth of a percent to 26 percent. The City of Tucson tax rate increased effective July 1 2017 from 2 to 25 for most business activities and increased effective March 1 2018 from 25 to 26 for those same business.

The County sales tax rate is 0. The City of Tucson asked voters to extend the existing temporary half-cent sales tax for an additional 10 years. The Tucson sales tax rate is 26.

On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate. Proposition 310 which aims to increase the states sales tax by 01 to fund a Fire District Safety Fund is failing with only 48 voter approval according to unofficial. 19-01 to increase the following tax rates.

There is a 60-day period before implementation so customers and transaction privilege tax TPT-licensed businesses have time to prepare for the tax rate change. On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate. This extension will not increase the Citys current sales tax rate of 26.

To find all applicable sales or use tax rates for. Effective July 1 2017 the rate will rise from 20 to 25. Tucson Tax and License Online.

As UA is exempt from the. This is the total of state county and city sales tax rates. The sales tax jurisdiction.

Tu business code tax rate. There is no applicable special tax. The Tennessee Department of Revenue is reminding Lewis County residents and business owners of a change in that countys local sales tax rate.

The Arizona state sales tax rate is 56 and the average AZ sales. The Use Tax has an indirect benefit to Tucson businesses because it. The current total local sales tax rate in Tucson AZ is 8700.

Sales Tax Rate for. The Arizona sales tax rate is currently 56. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax.

This web page contains changes to existing sales or use tax rates. During the August 4 election. On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate.

The Arizona sales tax rate is 56 the sales tax rates in cities may. Retail Sales 017 to five percent 50.

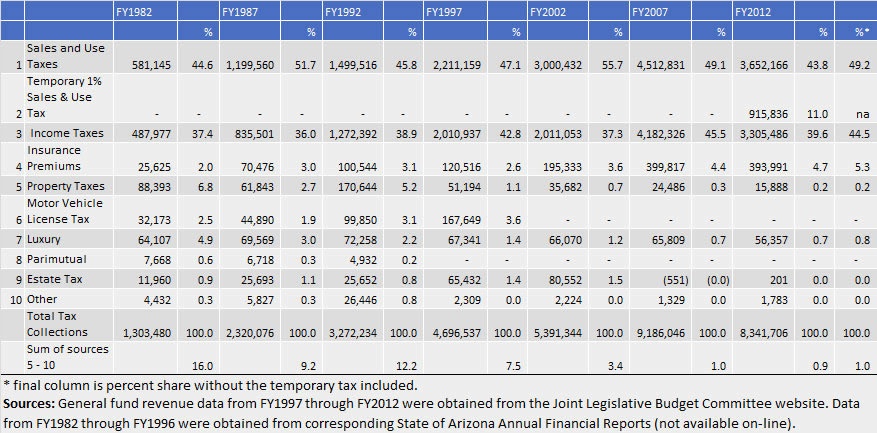

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy

How To Record Use Tax In Quickbooks Online For Sales Tax Reporting Go Get Geek

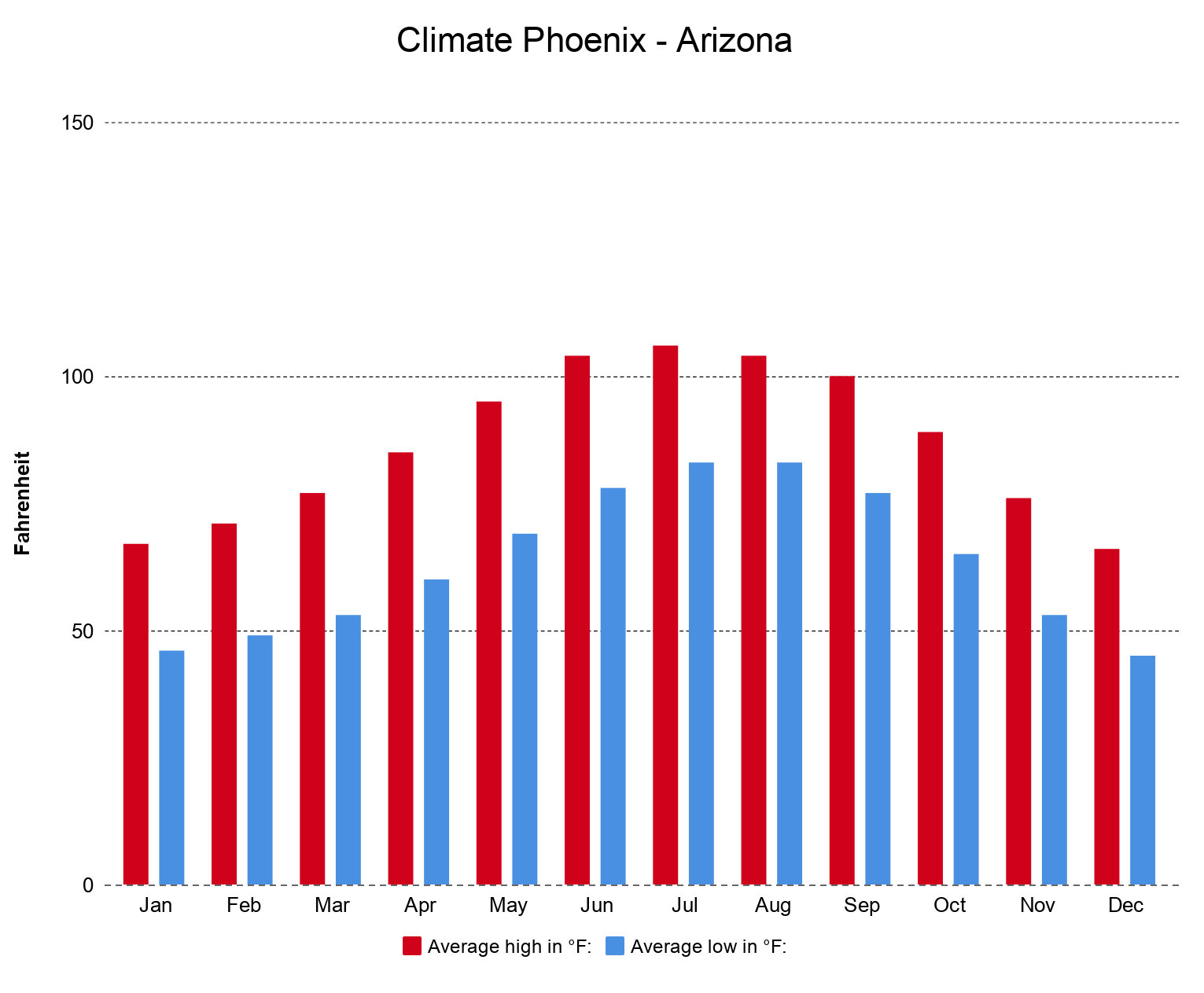

Moving From California To Arizona California Movers San Francisco Bay Area Moving Company

State And Local Sales Tax Rates In 2015 Tax Foundation

Sales Tax Rate Changes For 2022 Taxjar

Arizona Collected Extra 52m In Online Sales Tax In First 2 Months Of New Law Local News Tucson Com

Housing Bubble Woes Sales Of Homes Below 500k Plunge Total Sales Drop To Lowest Since Lockdown Supply Jumps Wolf Street

What Is Illinois Car Sales Tax

Rate And Code Updates Arizona Department Of Revenue

Updates To The 2022 Illinois Trade In Tax Credit Castle Chevrolet

Recent Arizona Tax Law Changes Beachfleischman Cpas

Tucson Voters Approve Keeping Half Cent Sales Tax For Road Improvements

Two Thirds Of Metros Reached Double Digit Price Appreciation In Fourth Quarter Of 2021

A Complete Guide On Car Sales Tax By State Shift

Sales Tax Liability Report Has A Bug

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates